Indianapolis—Eli Lilly & Co. strutted into 2025 with a first-quarter performance that should’ve had Wall Street popping champagne. Revenue clocked in at $12.73 billion, a 45% leap from last year, driven by blockbuster weight-loss drug Zepbound and diabetes treatment Mounjaro. Adjusted earnings per share hit $3.34, blowing past analyst expectations of $3.02. But the party fizzled fast on May 1 as Lilly slashed its full-year profit forecast and news broke of a stinging blow from rival Novo Nordisk.

Lilly’s stock took a 6% nosedive in premarket trading, a gut punch for a company riding high as the world’s most valuable healthcare firm, with a market cap north of $800 billion. The profit outlook cut was brutal: Lilly now expects adjusted earnings between $20.78 and $22.28 per share for 2025, down from $22.50 to $24.00. The culprit? A $1.57 billion charge tied to its acquisition of an oral cancer drug from Scorpion Therapeutics, a deal finalized in the first quarter. Lilly held firm on its sales guidance, projecting $58 billion to $61 billion, but that wasn’t enough to soothe investors’ nerves.

Then came the real kicker. CVS Health, the nation’s largest pharmacy benefit manager, announced it would drop Zepbound from its main commercial formularies starting July 1, favoring Novo Nordisk’s Wegovy instead. The decision, revealed on May 1, stemmed from a deal that made Wegovy cheaper for health plans. For Lilly, it’s a blow to Zepbound’s momentum, which had just overtaken Wegovy in weekly U.S. prescriptions, hitting 339,000 for the week ending April 18 and claiming a 53.3% market share. CVS’s move could tilt the scales back toward Novo Nordisk in the cutthroat obesity drug market, projected to hit $100 billion by decade’s end.

Lilly’s CEO, David Ricks, tried to downplay the CVS decision during an investor call, arguing it mostly affects small employers, many of whom don’t cover obesity drugs anyway. He called the move “the wrong idea” for reducing patient choice, but the market wasn’t buying it. Shares of Novo Nordisk, meanwhile, jumped 5% on the news, a rare bright spot for the Danish drugmaker, whose stock has shed over half its value in the past year.

The obesity drug race has been a two-horse sprint, with Lilly and Novo Nordisk trading blows. Zepbound, launched in the U.S. in December 2023, has edged out Wegovy in efficacy, with clinical trials showing greater weight loss. Lilly also boasts a stronger pipeline, including a promising oral weight-loss pill, orforglipron, which reported positive Phase 3 results on April 17. But Novo Nordisk isn’t lying down. Its deal with CVS underscores a savvy pricing strategy, with Wegovy’s costs trimmed to secure formulary preference, a tactic Lilly countered earlier this year by slashing Zepbound’s price for lower doses to $349 and $499 per month.

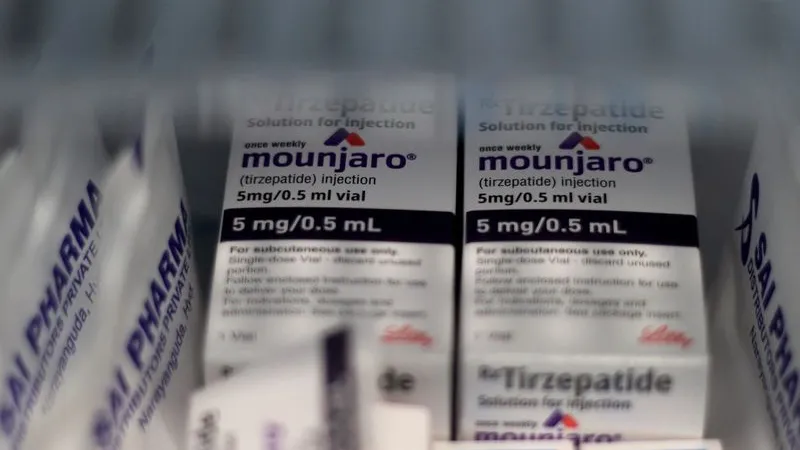

Lilly’s Q1 numbers were undeniably strong. Mounjaro sales reached $3.84 billion, topping estimates of $3.80 billion, while Zepbound brought in $2.31 billion, meeting expectations. U.S. sales soared 49% to $8.49 billion, fueled by a 57% surge in prescription volume for both drugs. Yet, lower realized prices for Zepbound, partly due to competition from compounding pharmacies, took a bite out of revenue. The FDA’s December 2024 decision to end the U.S. shortage of tirzepatide, the active ingredient in both drugs, has helped Lilly by curbing cheaper, unapproved versions, but the CVS snub threatens to undo that gain.

As the dust settles, Lilly remains a titan, but the May 1 double whammy—its own profit cut and Novo’s CVS coup—has exposed cracks in its armor. The obesity drug market is a high-stakes chess game, and every move counts.

Eli Lilly reported $12.73 billion in Q1 revenue, up 45% year-over-year. Adjusted earnings per share were $3.34, beating estimates of $3.02. Full-year 2025 adjusted earnings guidance was lowered to $20.78-$22.28 per share from $22.50-$24.00. CVS Health will exclude Zepbound from its main formularies starting July 1, favoring Wegovy. Zepbound had 339,000 weekly U.S. prescriptions for the week ending April 18, with a 53.3% market share. Novo Nordisk’s stock rose 5% on May 1; Lilly’s fell 6%.